Credit rating agency, Moody’s 2017 outlook for the higher education sector noted:

- Expense pressures will increase as key revenue streams likely soften, resulting in potentially weaker 2018 fiscal year cash flows. Furthermore, the direction of federal policy for higher education, including funding for key programs, is highly uncertain

- President-Elect Trump’s proposal to discourage companies from employing H-1B workers would likely reduce international student enrollment, if enacted. It would also negatively affect universities with lesser-known global brands. The uncertainty around immigration policy changes could also discourage international students from enrolling in U.S. schools, which would place further pressure on net tuition revenue

- Softening revenues and increasing labor costs are other pressures which could emerge, as endowment payouts are likely to shrink and wages tick higher as the labor market strengthens

Moody’s outlook illustrates that higher education continues to be under financial stress. Universities and colleges are constrained from raising tuition costs appreciably. Also, other funding sources like investment returns and donations are not as readily available as was the case in the past. As a result, there is pressure on the budget process, which is now more critical than ever. Budgeting in higher education has historically been somewhat of a mechanical process that involves people putting numbers into Microsoft Excel forms, rather than a strategic exercise.

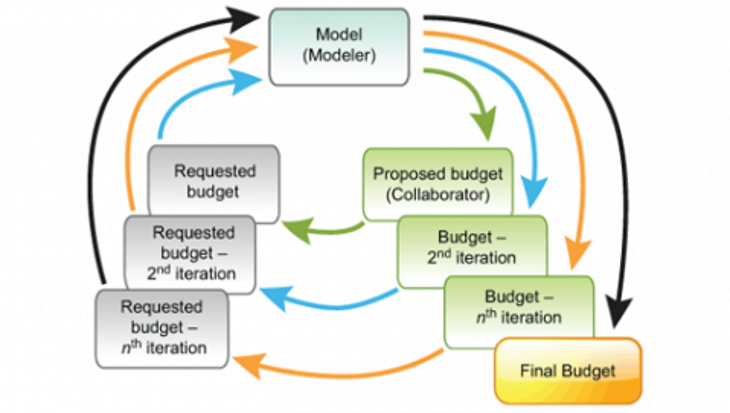

Early adopters in higher education understood that there was a need to come up with an alternative approach to face the budgeting dilemma. They embraced the concept of collaborative budgeting – a process of obtaining more participation in and providing ownership over the budget by faculty and staff department heads. Collaborative budgeting delivers more transparency and promotes support from department heads for the institutional strategy, as opposed to simply budgeting to history or individual wants and needs. It is collaboration between various stakeholders with the common goal of improved financial performance of the institution. There is significant evidence to suggest that institutions that embrace Collaborative Budgeting are outperforming those that are reluctant to implement this game-changing concept.

The most efficient way to implement the process of collaborative budgeting is the use of Business Enterprise Software that delivers the right information, flexibility and ease-of-use to help faculty and staff department heads build better plans. Business Enterprise Software can also free up thousands of hours of finance resources; it is easy to update with changes; can electronically communicate with the appropriate ERP systems and improve both the efficiency and effectiveness of the budget process. All of this will contribute to improved financial performance of the institution without the need for additional staff.

Questica Budget for higher education offers a centralized comprehensive budgeting platform that allows all stakeholders access to the information they need, while maintaining organized workflows and safe communication. It is available in both a traditional on-premise deployment and as a cloud-based solution.

Through Questica’s Higher Education budgeting software, colleges and universities can conduct enrollment reporting, funding gap and revenue analysis, capital project planning and reserve analysis and more. The platform also allows organizations to test numerous potential future scenarios to plan ahead and offers a rapid implementation reducing the time-to-deployment, plus a very competitive total cost of ownership.

Questica currently manages over $55 billion in annual public sector budgets. Collaborative Budgeting in Higher Education is a matter of when, not if, so why not take the first step today and request a demo of Questica Budget.