The Volcker Alliance is a nonpartisan organization that works to advance the effective management of government to achieve results that matter to citizens. Volcker Alliance’s “Truth and Integrity in State Budgeting: Preventing the Next Fiscal Crisis” is their second assessment of all fifty U.S. state budgeting practices, covering the fiscal years 2016 through 2018 and giving each state a grade based on their budget practices. Their first report in 2017 was “Truth and Integrity in State Budgeting: What is the Reality?” which reviewed state budgeting and financial reporting practices, and graded each state.

The Volcker Alliance report reveals that even following an economic boom, many U.S. states struggle to balance their budgets when faced with the obligation to pay for the increasing cost of healthcare, infrastructure, education, and public employee retirement costs. By reviewing how each state prepares their budget, the report sheds light on best practices that lead to balanced budgets, and as a result, will help mitigate the impact of financial challenges or another economic downturn. While the report focuses on states, the recommended best practices are also relevant for local city, town and county governments and related agencies.

State and local governments can refer to the Government Finance Officers Association for the latest best practices while the Volcker Alliance report focuses on five key categories of best practices:

Budgeting Forecasting

For the budget to be helpful as a planning tool, states need to make predictions about revenues and expenditures for more than just the following fiscal year. By creating multi-year forecasts of revenues and expenditures, states can determine whether any future structural budget deficits or gaps may occur. The report recommends using a consensus approach to estimate revenues and expenditures, taking into consideration suggestions from executive and legislative branches to avoid making politically driven decisions. While there are multiple best practices that would assist states in successfully balancing their budgets, making the effort to forecast future revenues and expenditures is the most critical according to the report.

Budget Accounting

The Volcker Alliance strongly believes that states should pay for expenditures in the same year they are accrued and not defer them into the future. When states use budget-balancing maneuvers or one-time actions to cover shortfalls, it often results in the maneuver needing to be repeated year after year, creating a structural imbalance between revenues and spending. With most states using a cash-based accounting system, the report suggests shifting to modified accrual accounting techniques widely used by state and local comprehensive annual financial reports to provide a more accurate picture of the state’s financial health.

Funding Legacy Costs

According to the Volcker Alliance, the biggest financial burden on states is to pay for retirement benefits to current employees, continue funding postemployment benefits, plus pay down the debt of the years the recommended actuary contributions to pensions were not made. States need to consistently make contributions that fully fund their pensions and retiree health plans to avoid assuming debts that could take decades to pay down.

Fiscal Reserve Funds

Reserve funds like rainy-day funds or year-end general funds are tools that help states keep fiscally stable. The report recommends that states create clear guidelines regarding withdrawals from rainy day funds and other fiscal reserves, as well rules on replenishing the funds that were taken. Without putting into place controls, spending could result in increases to recurring costs instead of short-term infusions of cash for unexpected emergencies or economic upheavals.

Transparency

Transparency refers to how completely the state is disclosing budget information, such as debts, tax expenditures and the cost of deferred infrastructure maintenance. The report states that legislators, advocacy groups, executive branch officials and citizens should not have to dig deep through data to understand a state’s budget. Although every state shares budget data, the information is not comprehensive enough for anyone to thoroughly understand the budget. As a best practice, states need to share with their citizens clear, accessible, and detailed tables of outstanding debt and debt service costs, and an annual or biennial accounting of the cost of tax exemptions, credits and abatements.

The Volcker Alliance Truth and Integrity report declares: “Fiscal sustainability is the key to successful budgeting.” As such, the report is not just a grading of each U.S. state, but serves as an important reminder about how striving for fiscal sustainability is critical. Recovering from the U.S. recession has enabled states to implement budgeting best practices, but since the same fiscal pressures from that time have not been alleviated, states are managing to balance their budgets, but likely without following best practices to reach that result. The report makes it clear that implementing better budget practices, particularly concerning budget forecasting and accounting practice, as well as consistently contributing to reserve funds and employee pensions, and finding new ways to increase transparency and share financial information, can minimize the impact of another economic downturn.

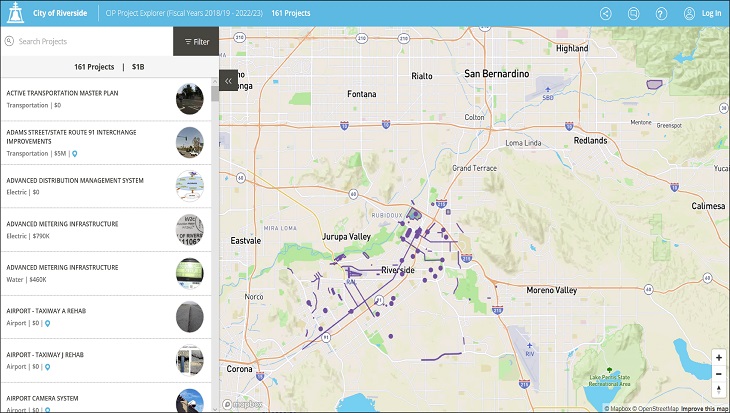

Implementing the Volcker Alliance’s budgeting best practices requires an efficient and collaborative budget preparation and management solution that saves your state, city, town, county or agency time for focusing on implementing, forecasting and reporting that budget. With a secure, cloud-based solution that offers multi-year budgeting for operating, salaries and capital budgets, Questica Budget Suite provides one version of data truth public sector organizations can trust to make better data-driven decisions. With the ability to forecast, analyze, report and create what-if scenarios organizations can gain meaningful insights from the budget when forecasting for future revenues and expenditures. With a built-in module for performance measures, an organization can monitor a system of programs and scorecards to track unlimited budget and non-budget key performance indicators (KPIs). Questica OpenBook is a sophisticated data visualization tool that translates budget data into interactive maps, charts, tables, graphics with descriptive text and informational pop-ups that increases transparency, trust and engagement with stakeholders and citizens. With the right tools, implementing the best practices advocated by the Volcker Alliance is easy and will help the public sector serve their communities with truth and integrity.

To learn more about budgeting best practices for your State or local government, read one of our blogs or white papers, or sign-up for one of our free monthly informational webinars.

About Questica

For over 20 years, Questica been working with public sector organizations – cities, towns, counties and related agencies – to better enable data-driven budgeting and decision-making, while increasing data accuracy, saving time and improving stakeholder trust. Our customers are using our Questica Budget suite to drive budget transformation by creating a single source of data truth. Over 700 organizations across North America in 47 states and 11 provinces/territories have eliminated spreadsheets opting for smarter planning, budgeting, performance measures, management, reporting, transparency and engagement with our software solutions. To learn more about Questica and how our software solutions can help your public sector organizations – check out our resources and news/blog sections, or request a demo today!